Cuba: What Are the New Realities for FDI and Trade?

After all the hoopla of shared baseball games and joint press conferences featuring a side-by-side US President Barack Obama and Cuban President Raúl Castro, announcing that “the Cuban embargo will end,” what are the realities for businesses looking to enter the Cuban market?

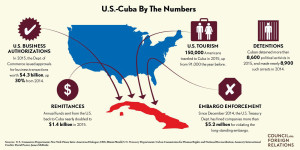

The Council on Foreign Relations’ infographic on the contradictory state of US-Cuba relations in early 2016.

Despite liberalizations, for real business prospects to develop, 1) the US embargo must end, and 2) Cuban needs institutional (legal) stability. The good news: there are indications these things will come to pass. The bad news: it will not be overnight. However, it is worth starting to plan strategies across sectors.

The Inevitable Demise of the US Embargo

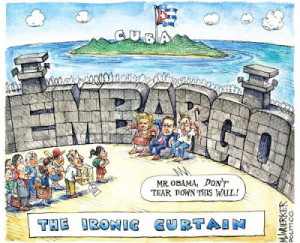

After the 1962 Cuban Missile Crisis, the US embargo on Cuba was strengthened with the 1992 Cuba Democracy Act and the 1996 Helms-Burton Act. Jointly they stipulated that the embargo may not be lifted until Cuba holds free and fair elections and transitions to a democratic government that excludes the Castros. Despite Obama’s executive orders, goodwill trips and speeches, it will take an act of Congress to repeal those. Congress is Republican-dominated, and the Republicans (those of Reagan’s “tear down this wall” speech) have sworn up and down that they will oppose it. But their feet are increasingly made of mud in this arena.

Real changes started in May 2015 when Cuba was removed from the State Sponsor of Terror list (long overdue, in Asymmetrica’s well-chronicled view). This allowed an increase from 10% to 25% of US components for products sold to Cuba. The complete end of the embargo is inevitable.

The Republicans, who took credit for pulling down the Berlin Wall, resist doing the same with the Cuban embargo.

The main factors putting pressure on Republicans to repeal the embargo are:

- The Cuban-American community in Florida who have voted Republican since 1980 and been rabidly anti-liberalization has changed. Their children have grown up here and they have a more nuanced (less angry) view of the Castros, as well as the role of trade in liberalizing societies. Evidence: Obama won the Cuban-American vote in Florida in 2012.

- The industries most keen to enter the Cuban market are industries that give a lot of money to the Republicans: telecommunications, farming, oil & gas.

The Cuban government has itself estimated that the embargo has lost them $1.126 trillion over the past 50 years. Raúl Castro has said he will step down in 2018; his likely replacement is much debated — though it seems unlikely that his successor would take power through the “free and fair elections” the twin pieces of embargo legislation envision.

Current Business Winners

Cuban officials are currently taking bids on 250 projects valued at $9 billion. They are prioritizing:

- Tourism: hotels, marinas and golf resorts

- Biotech and pharmaceuticals

- Bottling factories

- Renewable energy

These priorities are borne out in the agenda of the Cuba Industria 2016 Expo to take place in Havana, June 20-24.

Airbnb

Airbnb can take clients of all nationalities. Because Internet connectivity is low in Cuba, they will have in-country personnel who will make phone calls to confirm bookings.

Carnival Cruises

In May, Carnival will start running 7-day cruises that will stop in Havana, Cienfuegos and Santiago de Cuba that will cost $1,800 per person. This alleviates the immediate hotel room shortage in Cuba, but (in keeping with current US regulations) passengers must spend 8 hours a day on a “cultural experience.”

They will provide wifi and cyber searches.

Major League Baseball

Cuban nationals will no longer need to apply to OFAC (Treasury’s Office of Foreign Asset Control) to become an “unblocked national” to sign with an MLB team, which used to take up to a year.

Starwood

In February 2016, Starwood announced that it had signed deals to manage two Havana hotels and signed an MOU on a third. This is the first such deal since Castro’s Revolution of 1959, when the gringos and their mobsters were kicked out of their Cuban casino playgrounds. While Starwood’s deal sounds exciting, as everyone is anticipating a tourist stampede into Cuba, it is for management, not ownership. This suits the Castros and the Americans. The deal would have had to be approved as a one-off because tourism remains a sanctioned industry (more on this below) because tourism is owned by the Cuban military.

Verizon and Sprint

They already offer roaming services for US visitors to Cuba.

Western Union

Western Union has US approval to transfer money from anywhere in the world to Cuba. This is an expansion of the work they have been working with the Cuban government since 1995 to transfer remittances. In response to the opening, Cuba promises to end the 10% tax on US dollars entering Cuba (mainly as remittances). This move will make the regime more popular with its own people, at a time when it is trying to manage the changing image and relationship.

Reasons for Caution

The US-Cuba Trade and Economic Council, which advocates an end to the embargo, has reported that most of the 437 businesses polled intend to wait for now. Since the Castros signed the new investment law in 2014, out of 200 projects on the island, only 3 dozen have been approved. 90% of executives polled have gone just once to Cuba, and 80% said the trip “unproductive” and they had “rock-bottom expectations” of closing deals in the next two years.

There are a couple of cautionary tales. In the 1990s, Canada stormed into Cuba with fistfuls of JVs. Most had folded a decade later. There is also the case of Cy Tomakjian, who for two decades did various JVs with various government ministries until 2014, when he suddenly had his property (worth tens of millions of dollars) seized and was sentenced to 15 years for corruption. He was deported instead in 2015. The problem, he says is that there is “no clear definition of what is legal and legitimate. Cuba is risky business.”

Part of the problem is cultural: the official coordinator for foreign investment, Deborah Rivas, said to regime mouthpiece Granma: “This is not about doing whatever project that interests whichever foreign investor. We are not in the process of the accelerating the privatization of the Cuban economy.” She might well have been playing to the audience: a regime that cannot be seen as selling out its people’s property and labor after half a century. Even so, it shows that there is much work to be done on the political psyches on both sides of the 90-mile-wide waterway: both the US Republicans and the Castristas need to accept that their half a century of rage has yielded little and they need to come to a more practical approach.

Even as sanctions ease, regulatory and compliance risks will remain high.

The investment and development opportunities are outlined below, and given the red, yellow or green light by Asymmetrica Latin America‘s analysis.

Cuba’s population is grossly underserved by the Internet or even basic telephone services. This is the first sector in which the US has removed the embargo completely, and Sprint, Verizon and Google are already in there. No doubt the sector (particularly ISPs) will face censorship restrictions from the Cuban government, but the Cuban government understands that it cannot develop the country economically without cyber and telecoms.

Green energy sources are high on the Cuban political agenda and the US exempts any company that provides technology that protects the seas and skies. The Cuban government considers air conditioning a human right, making electricity use inordinately high per capita, especially considering the rest of its infrastructure. However, as ever, the legislative framework is vague — and given “the human right” clause, the financial return of such an investment is likely to become politically complicated.

While some restrictions are still in place by the US, the sector is opening fast. The main changes that were authorized last week include:

- U-turn payments: financial transactions can pass through the US financial system, where neither the originator nor the beneficiary is a person subject to US jurisdiction;

- Processing of US dollar monetary instruments: US banks will give US dollars to Cuban banks;

- Correspondent accounts at third-country financial institutions for these transactions may be denominated in US dollars;

- US bank accounts for Cuban nationals: US banking institutions will be authorized to open and maintain bank accounts in the US for Cuban nationals in Cuba to receive payments in the US for authorized or exempt transactions and to remit such payments back to Cuba;

- Credit cards can already be used by US nationals in Cuba.

Cuba’s state-owned oil company CUPET (Unión Cuba-Petróleo) produces only about one-half of Cuba’s daily needs: Cuba consumes 160,000 bpd; CUPET produces 80,000 bpd. About 85% of that production is used to generate electricity in plants in Western Cuba. Cuba hopes to alleviate this draw by installing more green energy sources, like solar, wind and tidal.

Cuban drilling is complicated. Most of the wells close to shore are exhausted, so CUPET are increasingly drilling horizontally (currently, 8,000 meters horizontally) to reach wells farther out at sea. This brings them into potential conflict with both the US (in that narrow Florida Strait) and with Mexico (in that Eastern Gap of the Gulf of Mexico). Both the US and Mexico are concerned not only about a clash of interests, but about feeling the effects of a Cuban-generated oil spill. To mitigate that risk, there is an exception to the US embargo that US companies can sell Cubans equipment that will promote sound environmental practices. But buying that equipment requires cash flow in hard currency: so the environmentalists are joining the oil & gas industry in calling for the end of the embargo — not your usual bedfellows.

Despite the fact that Cuba is only 71 on the list of the world’s proven oil reserves (as of January 2015), it has signed (and even effective) accords with a number of significant industry leaders:

- China’s Greatwall Drilling Company (GWDC), a subsidiary of China National Petroleum Corporation (CNPC)

- Malaysia’s Petronas

- Spain’s Repsol

- Venezuela’s PDVSA

Cuba shares colonial history with Spain and ideological alignment with China and Venezuela, which is still in the grip of the Chavistas.

Besides, the low oil price and the difficult drilling conditions, Cuba also faces stiff regional competition from the Americans, Pemex, Petrobras and Sonangol USA, out of Houston.

Until green energy really takes hold, LNG is more likely to be the answer to Cuba’s future energy needs: neighboring Trinidad & Tobago have lots of it, and Sonangol stores it nearby, too. (Cuba intervened militarily twice in Angola — in 1975 and 1988 — in support of the leftists.)

Mariel SEZ provides the best opportunity, but it remains fraught with challenges. (See above.) The ports of Havana, Cienfuegos and Santiago de Cuba will need proper services to accommodate Carnival and other cruise liners. However, negotiations are likely to be contentious.

The main railroad between Mariel SEZ and Havana has already been built. Although it will undoubtedly need effective management and services, and the country could use more domestic railroads, entry into this market is bound to be fraught with Communist Party perils.

Because it funds the Cuban military, tourism is still officially sanctioned by the US, though OFAC and Commerce can (and did) grant permission on a case-by-case basis. However, Cuban property cannot be majority owned by a foreigner and supplies of foodstuffs and basic utensils to serve tourist are still difficult to attain. The regime has previously tussled with some of its more renowned hoteliers, including Marco Cardillo of the Saratoga Hotel, well known to Asymmetrica Latin America.

The full details of the changes of US Trade and Investment policy toward Cuba can be found here.

Asymmetrica Latin America has deep and effective reach into Cuba. If you would like to explore business opportunities in Cuba, please contact us: info@asymmetrica.net

![]()